Definitions

PPL: purchasing power loss.

PPL Account: individual accumulated loss of purchasing power account maintained for each beneficiary, the balance of which shall not exceed 8%.

Geneva CVI: annual variation of the Geneva consumer price index for the last twelve-month period (August to August), expressed in percentage points.

Funding ratio: actual funding ratio of the Fund in a closed fund technical balance sheet as confirmed in the annual financial statements of the Fund approved by the Council.

I. Method for the Annual Adjustment of Pensions

The method applicable for the annual adjustment of pensions differs pursuant to the date on which a person becomes a beneficiary of a pension.

1. Method for the annual adjustment of pensions for persons who became beneficiary of a pension on or before 31 December 2011

a) Persons who became beneficiary of a pension on or before 31 December 2011 shall receive no annual adjustment of pension unless their PPL account maintains a balance of 8%. Provided their PPL account has such a balance, the method set out in paragraphs 1 (b) and (c) shall apply.

b) (i) If the Geneva CVI is positive, the annual adjustment shall be the Geneva CVI, unless the conditions of 1 (c) are fulfilled;

(ii) If the Geneva CVI is zero, no annual adjustment shall be granted;

(iii) If the Geneva CVI is negative, no annual adjustment shall be granted but the resulting effective increase in purchasing power shall reduce the balance of the beneficiary’s PPL account.

c) When the funding ratio of the Fund has been greater than 110% for three consecutive years, beneficiaries who have incurred an individual accumulated loss of purchasing power shall be compensated as follows: provided that the Geneva CVI is positive and the funding ratio remains greater than 110%, their annual adjustment of pensions shall be the product of the Geneva CVI multiplied by the funding ratio, until such time as the balance of their PPL account is reduced to zero.

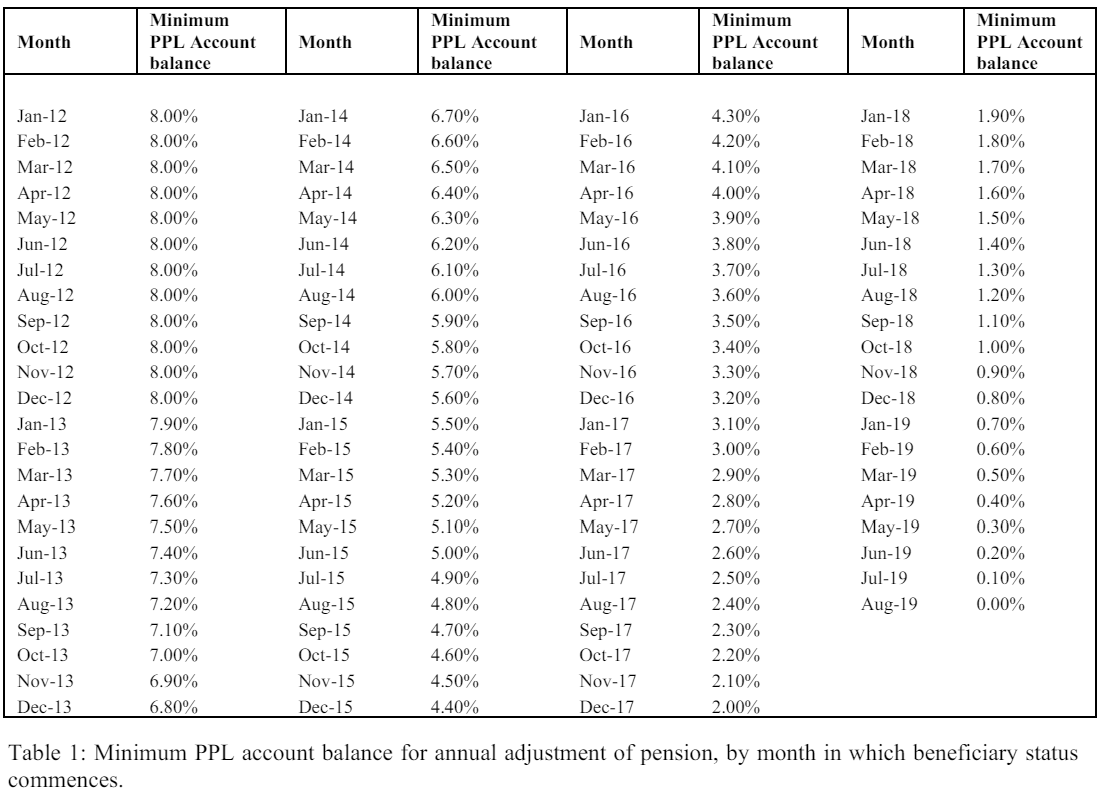

2. Method for the annual adjustment of pensions for persons who become beneficiary of a pension between 1 January 2012 and 31 July 2019

a) Persons who become beneficiary of a pension between 1 January 2012 and 31 July 2019, inclusive, shall receive no annual adjustment of pension unless their PPL account maintains no less than the minimum balance set out in Table 1. Provided their PPL account has such a balance, the method set out in paragraphs 2 (b) and (c) shall apply.

b) (i) If the Geneva CVI is positive and the funding ratio is less than 100%, the adjustment shall be the product of the Geneva CVI multiplied by the funding ratio, up to a maximum of the actuarial parameter for annual inflation as set out in the Actuary’s triennial report, always provided that no PPL account may exceed a balance of 8%1 ;

(ii) If the Geneva CVI is positive and the funding ratio is equal to or greater than 100%, the annual adjustment shall be the Geneva CVI, unless the conditions of 2 (c) are fulfilled;

(iii) If the Geneva CVI is zero, no annual adjustment shall be granted;

(iv) If the Geneva CVI is negative, no annual adjustment shall be granted but the resulting effective increase in purchasing power shall reduce the balance of the beneficiary’s PPL account.

c) When the funding ratio of the Fund has been greater than 110% for three consecutive years, beneficiaries who have incurred an individual accumulated loss of purchasing power shall be compensated as follows: provided that the Geneva CVI is positive and the funding ratio remains greater than 110%, their annual adjustment of pensions shall be the product of the Geneva CVI multiplied by the funding ratio, until such time as the balance of their PPL account is reduced to zero.

3. Method for the annual adjustment of pensions for persons who become beneficiary of a pension on or after 1 August 2019

a) Persons who become beneficiary of a pension on or after 1 August 2019 shall be granted an annual adjustment in accordance with the method set out in paragraphs 3 (b) and (c).

b) (i) If the Geneva CVI is positive and the funding ratio is less than 100%, the adjustment shall be the product of the Geneva CVI multiplied by the funding ratio, up to a maximum of the actuarial parameter for annual inflation as set out in the Actuary’s triennial report, always provided that no PPL account may exceed a balance of 8%2 ;

(ii) If the Geneva CVI is positive and the funding ratio is equal to or greater than 100%, the annual adjustment shall be the Geneva CVI, unless the conditions of 3 (c) are fulfilled;

(iii) If the Geneva CVI is zero, no annual adjustment shall be granted;

(iv) If the Geneva CVI is negative, no adjustment shall be granted but the resulting effective increase in purchasing power shall reduce the balance of the beneficiary’s PPL account.

c) When the funding ratio of the Fund has been greater than 110% for three consecutive years, beneficiaries who have incurred an individual accumulated loss of purchasing power shall be compensated as follows: provided that the Geneva CVI is positive and the funding ratio remains greater than 110%, their annual adjustment of pensions shall be the product of the Geneva CVI multiplied by the funding ratio, until such time as the balance of their PPL account is reduced to zero.

II. Method for the Annual Adjustment of the Fixed Sum and Allowances

The fixed sum and allowances shall be adjusted annually in accordance with the applicable method for the annual adjustment of pensions as set out above.

1 If a beneficiary’s PPL account maintains a balance of 8% and the Geneva CVI is positive, the Geneva CVI shall be granted notwithstanding the funding ratio of the Fund.

2 If a beneficiary’s PPL account maintains a balance of 8% and the Geneva CVI is positive, the Geneva CVI shall be granted notwithstanding the funding ratio of the Fund.