Disability Pension

Articles

Article II 3.01 Definition

Disability is a certified* permanent incapacity for work resulting from physical and/or mental impairment. It can be total or partial.

*Certification is a written statement by a doctor attesting a given medical condition

Article II 3.02 Entitlement to Total Disability Pension

Any member or former member with a disability recognised by the Organization greater than 50% or for whom it has not proven possible to implement a rehabilitation measure shall be entitled to a total disability pension.

Article II 3.03 Entitlement to Partial Disability Pension

Any member or former member whose disability recognised by the Organization is equal to or less than 50% shall be entitled to a partial disability pension.

Article II 3.05 Amount of Total Disability Pension

The amount of the total disability pension shall be equal to the retirement pension the member would have received at the applicable retirement age if he and the employing Organization had paid contributions up to that time on the basis of his final reference salary.

Article II 3.06 Amount of Partial Disability Pension

The partial disability pension shall be equal to the total disability pension multiplied by the rate of disability of the person concerned.

Article II 3.07 Disability arising in the Course of Duty

Notwithstanding Articles II 3.05 and II 3.06, if the disability results from an occupational accident or occupational illness or from saving a person, the disability pension for total or partial disability shall be calculated, subject to the provisions of Article II 1.13, on the basis of the applicable maximum period of membership specified in Article II 2.02.

Article II 3.08 Duration of Total Disability Pension

The total disability pension shall be payable up to:

a) the last day of the month of the death of the beneficiary;

b) the day on which the Organization deems that the disability has disappeared or reduced to less than 50%;

c) the day on which the beneficiary resumes membership.

The total disability pension shall terminate on the last day of the month following that in which the beneficiary reaches the applicable retirement age. It shall be replaced by a retirement pension of the same amount.

Article II 3.09 Duration of Partial Disability Pension

The partial disability pension shall be payable until:

a) the last day of the month of the death of the beneficiary;

b) the day on which the Organization deems that the partial disability has disappeared or has become total.

The partial disability pension ceases to be paid on the last day of the month before that in which the member retires. It shall be replaced by a retirement pension calculated in accordance with the Basis for Calculation of Benefits, as set out in Article II 1.08 of these Rules.

Article II 3.10 Increase of Partial Disability

Where the recipient of a partial disability pension suffers an increase in his rate of disability that is recognised by the Organization, the pension shall be increased accordingly.

Article II 3.11 Reduction in Partial Disability

Where the Organization recognises that the rate of disability of the recipient of a partial disability pension has decreased, the pension shall be reduced accordingly.

Article II 1.08 Basis for Calculation of Benefits

Benefits, with the exception of transfer values, are calculated on the basis of the highest of the following amounts at the time of termination of membership:

a) for members who joined the Fund on or before 31 December 2011:

i) the reference salary corresponding to the remuneration for 40 hours’ work per week;

ii) 10/7 of the reference salary corresponding to 99.35% of the midpoint of grade 1 of the CERN salary scale.

b) for members who joined the Fund on or after 1 January 2012:

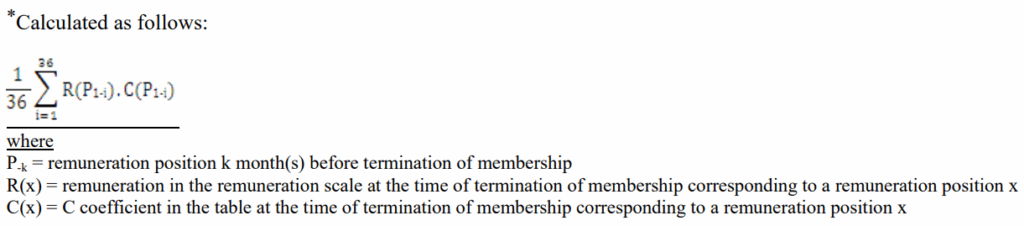

i) the average* of the last 36 months’ reference salaries, each corresponding to the remuneration for 40 hours’ work per week, derived from the salary scale effective at the time of termination of membership;

ii) 10/7 of the reference salary corresponding to 99.35% of the midpoint of grade 1 of the CERN salary scale.

Benefits thus calculated shall be reduced in application of Article II 1.13, as appropriate.

Article II 1.13 Reduction of Benefits

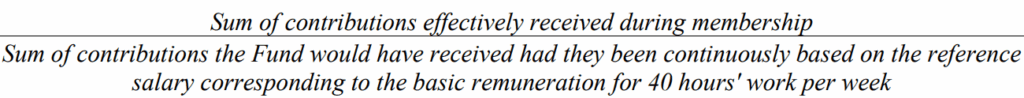

Where during the period of membership a payment has been made into another pension scheme (Article II 1.10) or where the contribution has not been continuously based on the reference salary relative to the member’s remuneration for 40 hours’ work per week as provided for in Article II 1.03, the period of membership used in the calculation of benefits, at the time they become due, shall be equal to the total reckonable period of membership multiplied by the following ratio: